A review of important tax information for international students

What Tax Forms Might You Need to Complete

Possible tax forms you may file or complete

- Form 1040 NR

- W-8 BEN

- W-7

- Form 43 – Idaho state tax returns

- Other State tax returns

- Form 8843

Requirements and Timeline for Taxes

Individuals who did not earn income but were present in the US during 2024 have the following requirement:

- File form 8843 for yourself and any dependents

Instructions and a link to the form may be found here - When filing only this form the due date is June 15, 2025

- You must file Form 1040NR if you have

- Wages or scholarship income exempt by treaty

- Wages of $4,000 or more

- Taxable scholarship income

- Federal Tax returns are now due by April 15, 2025

- State tax returns are due April 15, 2025

Consequences of Failure to File

Don’t Miss The Deadline!

- You may lose a refund that you are entitled to.

- You may jeopardize your immigration status.

Nonimmigrant alien status requires that the individual not violate any U.S. laws, including tax laws.

What Statement Forms Might You Receive

The following are the tax statements that you may receive

- 1042-S

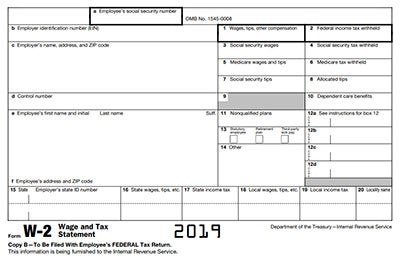

- W-2

- 1099

- 1095

1042-S – Sample Form

W-2 – Sample Form

Important caution

- The Sprintax Calculus Tax Summary report is DIFFERENT from your tax returns.

- The Tax Summary Report is a document produced when you complete your Sprintax Calculus record. It is used internally by Payroll and Tax Reporting to determine tax withholding of income earned.

- You would not have it, if you did not receive any taxable payments from the University.

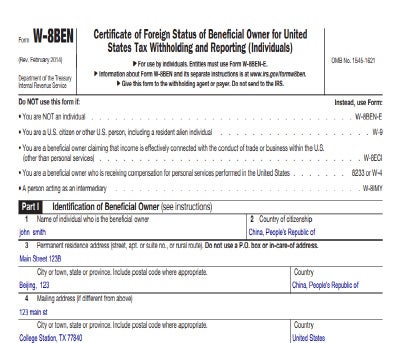

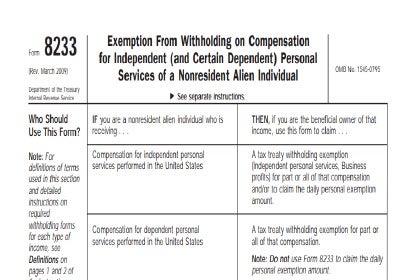

Sample W-8BEN and 8233 Forms

Example of 1040NR

- The returns that you will be submitting is called 1040NR

- You need to mail the forms to the IRS – There is no electronic filing for nonresident aliens

State tax return – When you need to file

You must file a US state tax return, if you

- Worked in the US

- Got a stipend, grant or allowance in 2024

- Expect a state/local tax refund

Idaho tax returns are due April 15, 2025

State tax resource – Sprintax

Boise State University has arranged access to Sprintax – Contact taxreporting@boisestate.edu to receive your access code.

All you need to do is

- Register with Sprintax

- Complete the online questionnaire

- Enter your unique code in the box on the “Review your order” page

- Sprintax will prepare your tax return

IRS Communications

- IRS communicates only to you

- Through the mail – Please respond to IRS letters as soon as you receive them

- Any emails/phone calls – Most likely to be scam !!

- Make sure your mailing address in the returns is accurate

Documents to have when filling the returns

Have the following documents for the tax prep sessions

- Passport

- 1042-S form and/or W-2 form

- Any other tax forms you received for 2024

- Bank account number and routing number

Tax Resources

- For quickest response, please send an email to taxreporting@boisestate.edu, include your name and detailed question

- Sprintax online service

- Volunteer Income Tax Assistance (VITA) Program

- Tax Reporting website – Year end information