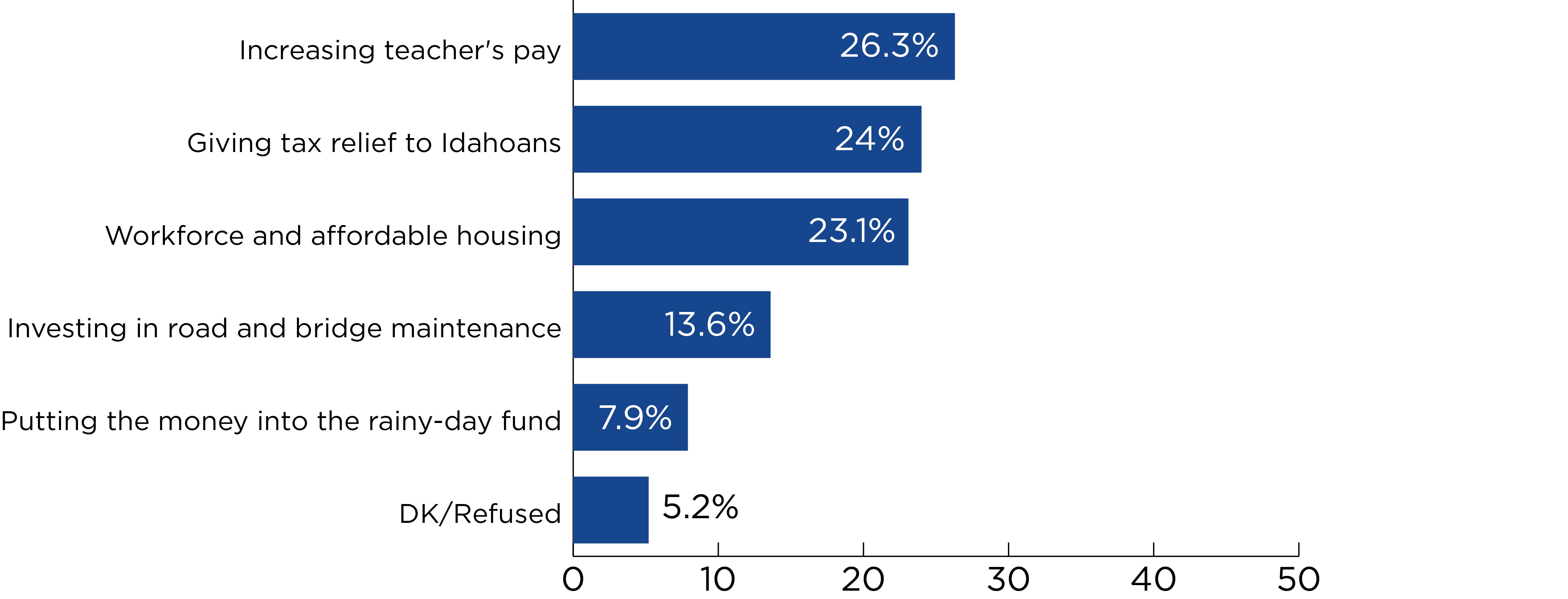

At the time of the survey, the State of Idaho was projected to have an approximate $1.5 billion budget surplus for the fiscal year. We asked the public how they feel the money should be spent.

Idahoans were split between three options on the best use of the surplus. Increasing teachers’ pay received the most support (26%), closely followed by giving tax relief to Idahoans (24%), and workforce and affordable housing (23%). Investing in road and bridge maintenance came in a distant fourth (14%) and putting the money into a rainy-day fund received the least support (8%).

Parties are split in their priorities. Republicans favor tax relief (30%) and increasing teachers’ pay (23%). Democrats most favor workforce and affordable housing (34%) and increasing teachers’ pay (33%). Independents favor increasing teachers’ pay (28%) and workforce and affordable housing (26%).

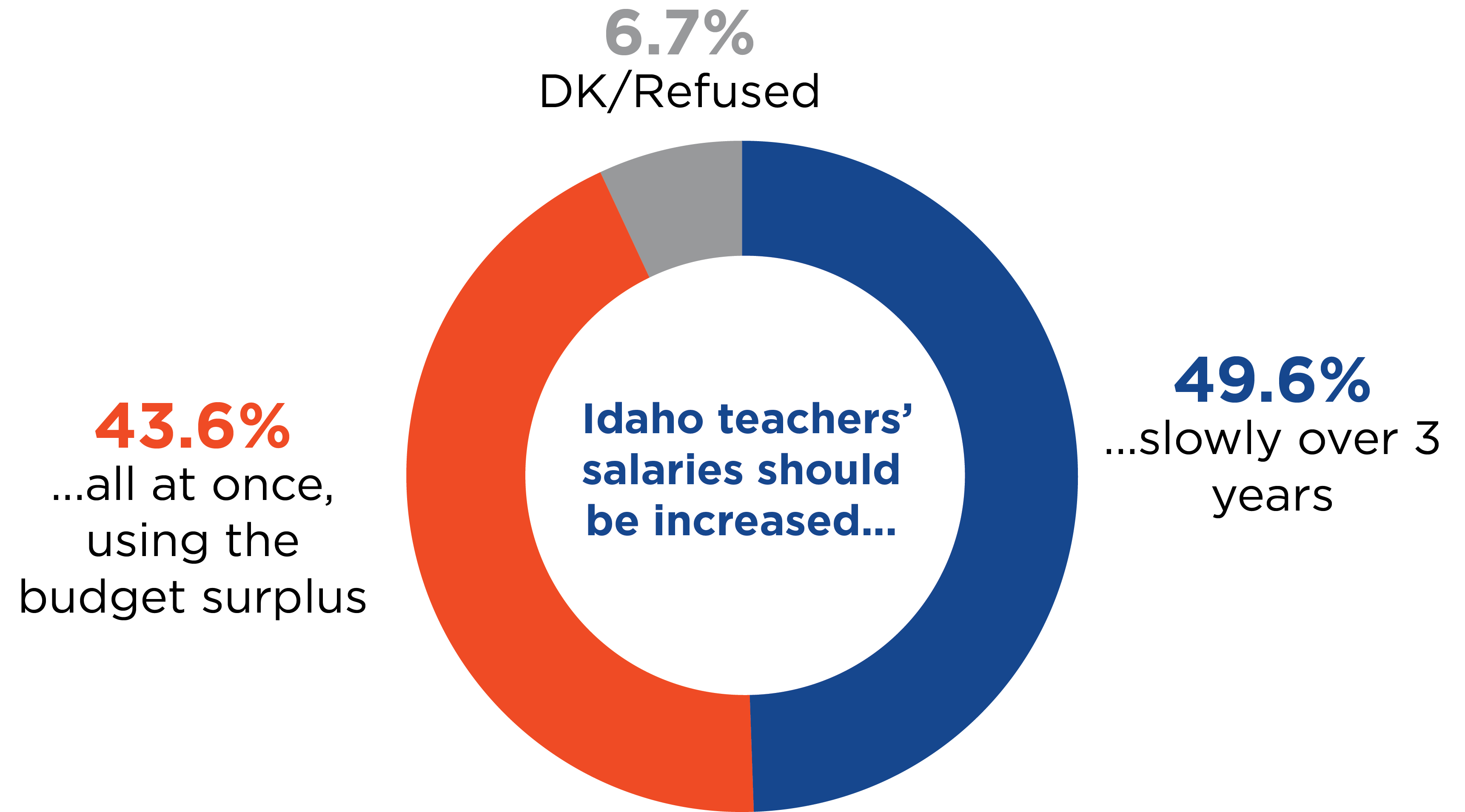

Idahoans are split on the best way to raise teachers’ salaries.The Idaho Legislature recently passed a pay raise for Idaho teachers that is scheduled to increase salaries over the next three years. Some have proposed using the budget surplus to increase teachers’ salaries now all at once. When given a choice between these two options, half (50%) favored salaries increasing slowly over the three-year period while 44% favored increasing salaries all at once. The immediate increase has the highest support among Democrats (66%), while a majority of Republicans (60%) favor a slower increase. Independents are split between the two options, with 45% favoring immediate increases and 47% preferring the slower timeline.

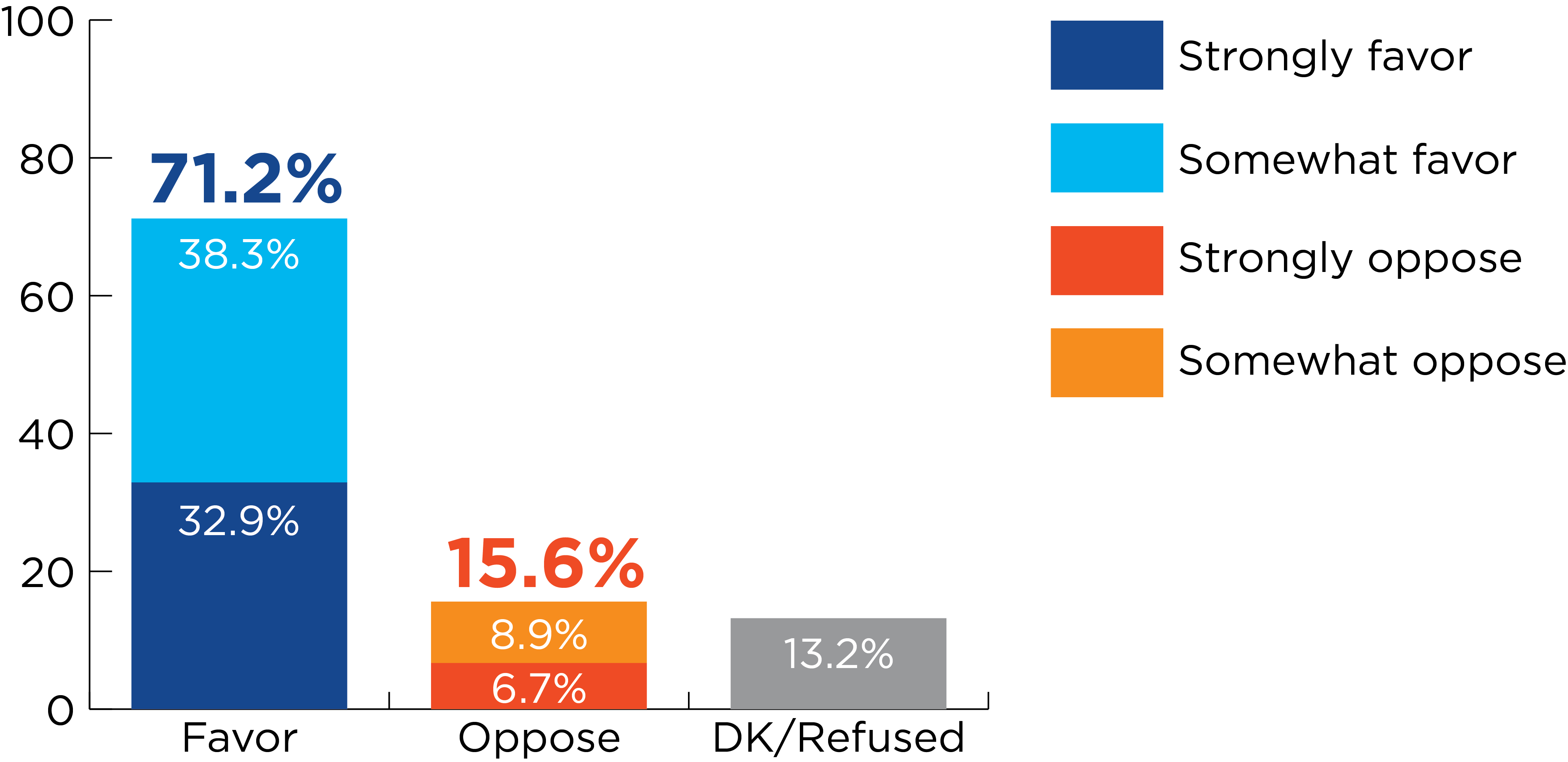

Another budget surplus proposal under consideration is to use it to pay down $225 million in debt that the State of Idaho has on properties around the state, under the rationale that doing so early would save at least $80 million in interest payments over the life of the loan. We asked Idahoans if they would favor or oppose this proposal. Results suggest strong support, with 71% indicating they would favor using the budget surplus in this manner and only 16% opposed.

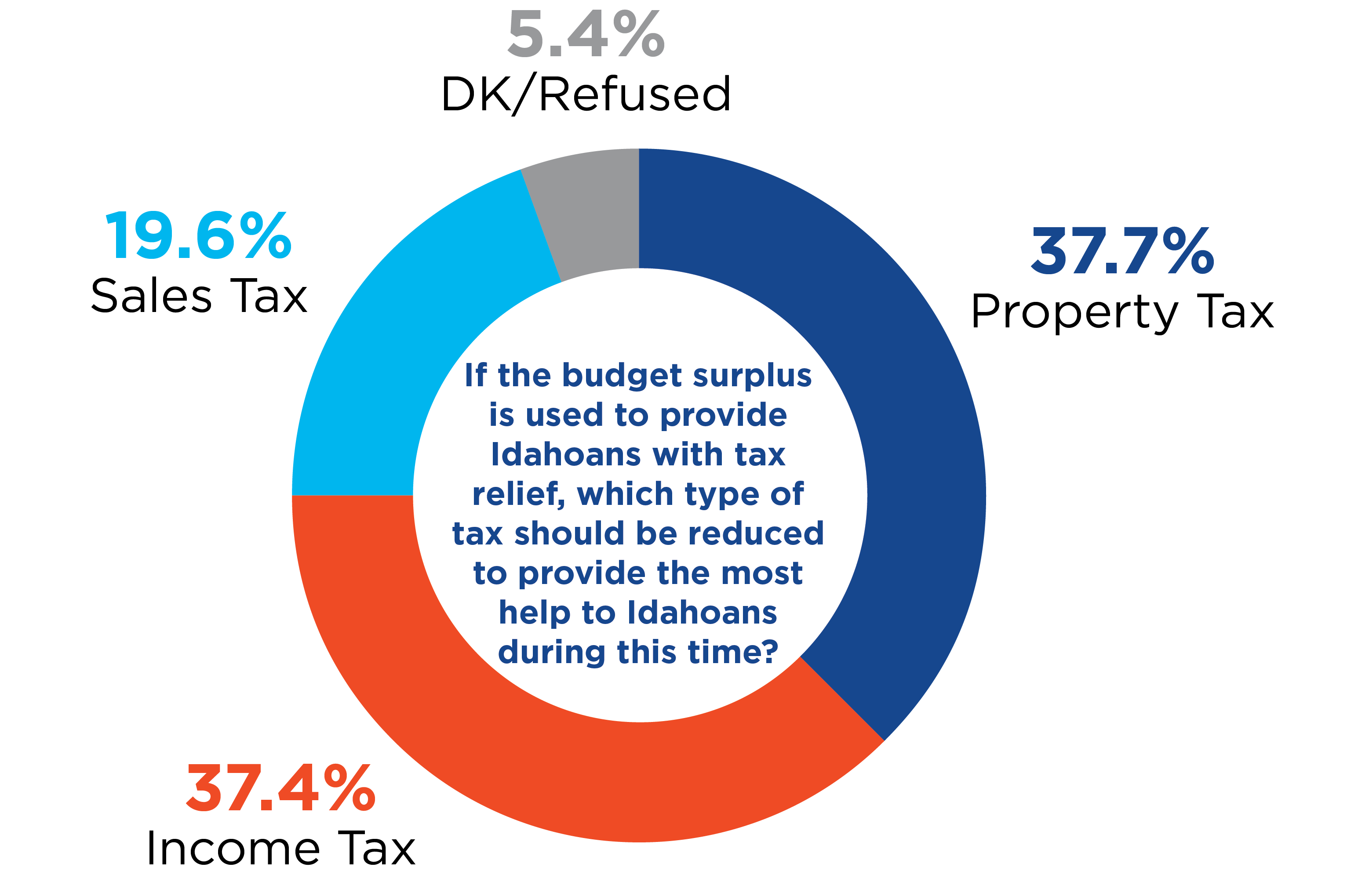

As we did last year, we asked Idahoans which type of tax reduction would provide the most help to Idahoans if the budget surplus is used to provide tax relief. Idahoans were split between property taxes (38%) and income tax (37%), a four point increase for property taxes over last year and a five point decrease for income taxes. Sales tax was a distant third (20%). Property tax was the highest response among all political parties, with 41% of Republicans, 44% of Democrats, and 36% of Independents identifying it as the best tax relief option.

Not surprisingly, home ownership also influenced responses. Property tax was the most frequent response among those who own their home (44%), while renters strongly favored income tax relief (50%) over property tax relief (22%).

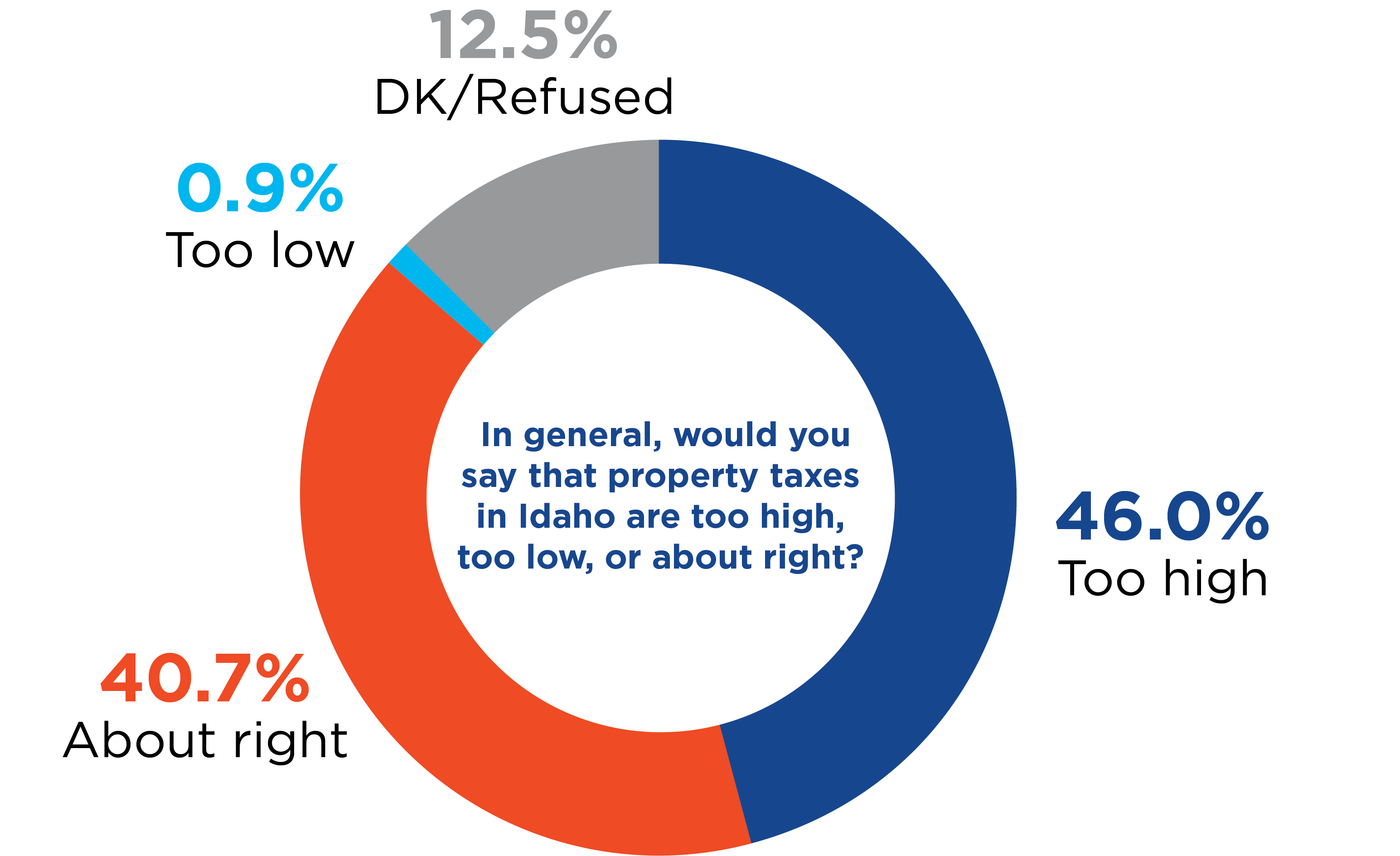

Increasing concern over property taxes is evident in other areas of the survey. We asked Idahoans whether they thought that property taxes in Idaho are too high, too low, or about right. Last year Idahoans were fairly split between too high and about right. This year more Idahoans (46%) think they are too high, a five-point increase. Few (1%) think they are too low, while 41% think they are about right, a three-point decline over last year. Canyon County (58%) and Twin Falls County (57%) are the areas of the state with the highest levels of property tax concern, with more than half of their respondents indicating they are too high.

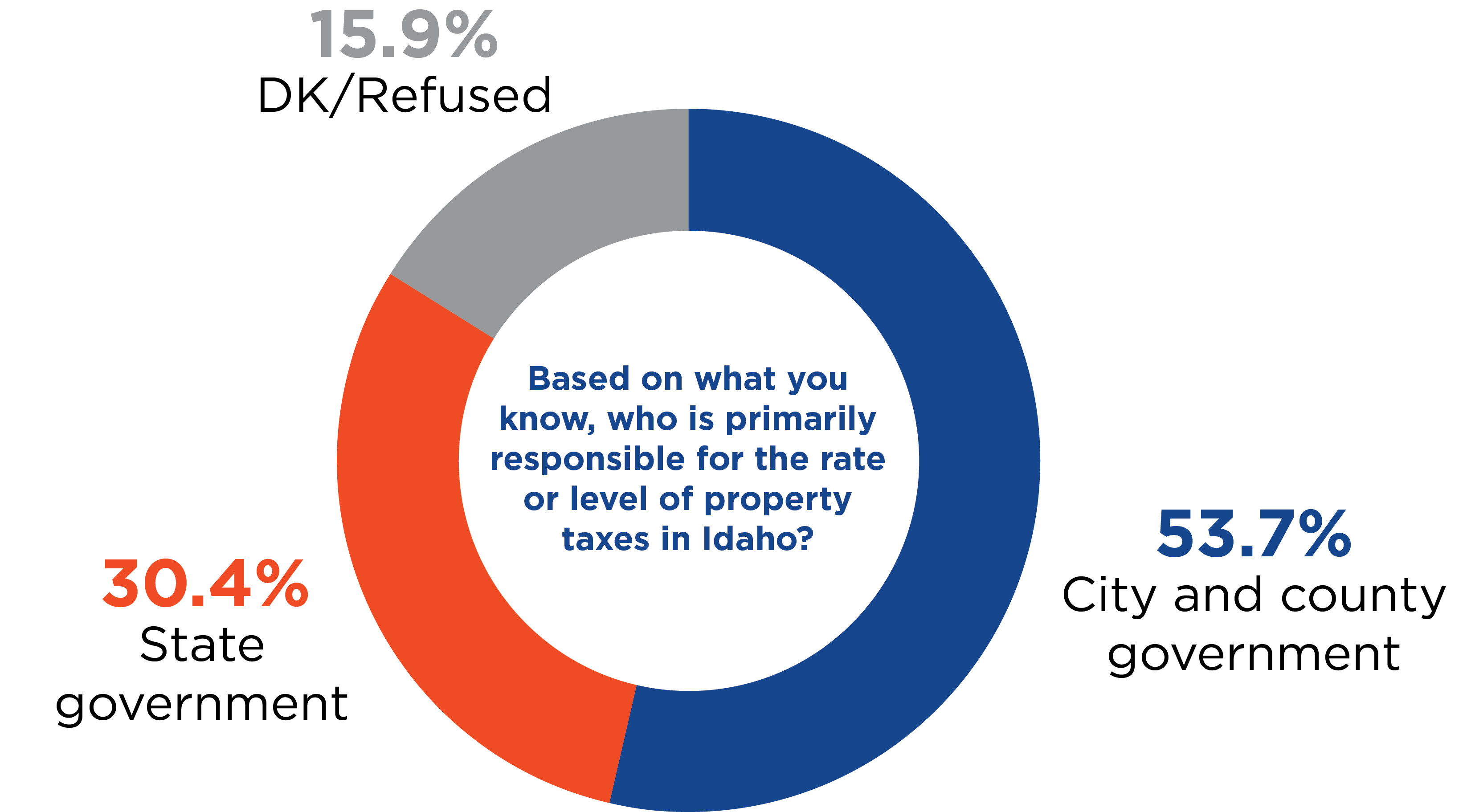

Property taxes are a complex subject. In Idaho, they serve as local governments’ primary revenue source and while local governments set property taxes through their budgeting process, they do so under the rules and parameters set by the state. This interrelationship makes addressing property tax levels complicated. With so many Idahoans indicating property taxes are a concern, we were interested in learning more about whose responsibility they consider them. We asked, based on what they know, who is primarily responsible for the rate or level of property taxes in Idaho. A majority of Idahoans (54%) believe that city and county governments are responsible, while 30% believe the responsibility lies with the state government. About 16% are not sure. Republicans (52%) and Independents (56%) are most likely to assign responsibility to city and county governments, while Democrats were more split between cities and counties (44%) and the state (41%).