My name is Kimber Wymore. I’m a native of the Boise area and have been working on my bachelors in Technical Communication here at Boise State, which I will be getting this May. I enjoy all aspects of writing, though my strength lies in all forms of technical writing. To me, writing is very important because, through writing, I believe we can open up many forms of communication and understanding with others and ourselves.

High Rent, Low Pay, and No Where to Go: The Affordable Housing Crisis

A house with a white picket fence, a family with 2.5 kids, and a well-paying 9-5 job. This was once the American Dream, but today many would settle for being able to afford a house or even an apartment. Though America’s economy may seem like it’s booming, and that the Great Recession from 2007 is just a thing of the past, something adverse is happening within the housing market called the Affordable Housing Crisis. This crisis is making it increasingly harder for young, single, and lower income persons, especially those who have grown up in the area, to afford housing due to high increases in rent, fewer affordable homes, and wages not keeping up with the increase in housing costs.

The standard for housing is to not exceed 30 percent of one’s income; however, today many are finding themselves paying an excess of than that with more than eleven million people spending 50 percent or more on housing alone (Emmons, Terwilliger). Due to spending most of one’s income on housing, there are fewer options for saving for the future. Since saving becomes nearly impossible when most of one’s income is going towards rent, including utilities and other bills, it becomes increasingly difficult to accumulate enough money for a down payment on a house. Even if one could scrimp and save enough money for a bare minimum of a down payment, there are fewer choices available on the market for purchase depending on the area. To look into the issue of affordability, it becomes necessary to look at it on a national scale, as well as locally at Boise Idaho.

Affordable Housing Crisis: National Analysis

Nationally, the number of renters has increased exponentially since the Great Recession and many are having a difficult time making that switch from rent to own. Several reasons being the devastating credit scores left over from the recession, the difficulty to save money, and the lack of programs to help with these issues. With this increased need for renting, apartments are becoming a coveted commodity, allowing landlords to set prices, and allows for overcrowding in large cities.

Many areas within California and New York, as well as large cities like Seattle, are epicenters of innovation, and where a lot of the current job market exists. However, due to overcrowding, and the extreme housing costs in those large cities, people are looking elsewhere to live. With the overflow of people moving around the country, “low-income residents are being pushed out of affordable communities by an influx of higher-earning newcomers who are drawn by the business opportunities and are able to pay higher rents” and since this is the case, it leads to landlords justifying how they can raise rent at such a high increase (Christensen-Garcia). Due to this, mixed with the fact that new construction slowed to a halt after the Great Recession, and fewer people upgrading to larger homes, there are currently fewer homes available on the market, and what homes there are, are raised to an extreme price. It is becoming a low supply, high demand market, and only those who can afford it benefit.

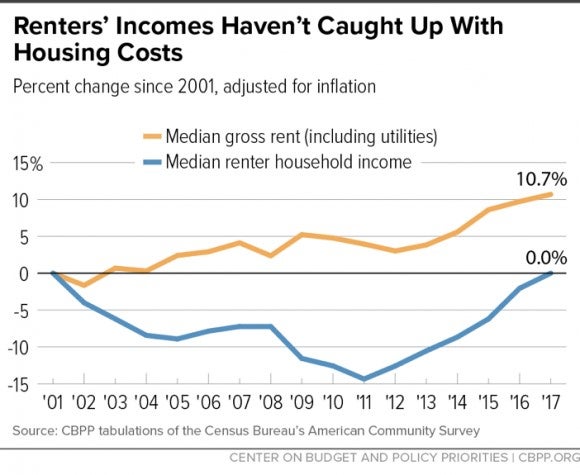

Another issue causing houses to be unaffordable is the rate of inflation for wages being lower than the increase in rent and housing costs. The “median sales price of existing homes was up 40 percent compared to the annual average in 2012, while incomes […] were up by only 12 percent” which shows the drastic difference between pay wages and housing costs (Cororation). This may sound good for current homeowners, but for those trying to become one, this isn’t helpful since the amount of money being earned isn’t staying ahead or steady with the cost of houses or even apartments, see Figure 1 (Mazzara). Not only is inflation not keeping up with housing, but it is even worse considering “inflation-adjusted rent has grown 61% vs. 5% inflation-adjusted income growth among renters” (Graham). It is becoming even more expensive to rent, and the costs are increasing even faster than purchasing a house. Typically, people rent because they can’t financially afford a home, but with the extreme increase to rent, as well as other factors like zoning laws, not enough undeveloped land, high cost of building materials, and a shortage of labor, people are steadily finding themselves unable to even afford to rent, let alone purchase or build a home (Siegler). Many of these issues are the last dregs of the Great Recession of 2007; it was over ten years ago, and yet its backlash on the housing market can still be felt, even if the market appears to be booming.

Housing prices have increased, and homes are being sold quicker than ever before, which in theory sounds like a productive economy, but when considering how few new homes are being created, and how costs of building have increased faster than wages, it can feel like a bubble will need to burst before prices level out again. When the housing recession hit, many within the construction business were left jobless, and needed to find other methods to provide a living. This has created an issue where new homes are in huge demand, and those that were once within the workforce of housing labor, are no longer there and have little interest in returning after finding other means of survival, with only about 40 percent of workers going back into construction (Where Did All The Construction Workers Go?).

Despite this crisis, and the possible economic fallout that may follow in its wake, there are a few options to help combat that situation. One recommendation is to “undertake a major and sustained investment in the production of new affordable rental housing” which will happen by creating “a significant expansion of the highly successful Low-Income Housing Tax Credit program” (Terwilliger). By expanding the Low-Income Housing Tax Credit program, more federal support will become available for helping those in need of attaining a home, and thus the gap will shorten between supply and demand, with there being more supply for those with low incomes. Increasing the supply of rental apartments would also be a step in the right direction, but in creating them, they would need to have a cap on how expensive they are. The goal with building new apartment complexes would be for them to be affordable, and available for those with lower incomes. Another way that may help this situation is to increase wages to where the basic standard of living can be achieved. If wages can keep up with the costs of renting then it should, theoretically, make affording them easier.

Idaho Housing Crisis: A Local Analyzation

Though the cost of rent has increased over the years on a national scale, rent of an average two-bedroom apartment in Boise is about $1,344 which has increased over 20 percent since 2017 (Sowell). This increase has happened largely to the population growth. A twenty percent increase within just one year is extreme. With this increase, and the issue of most people already spending over fifty percent of their incomes on rent alone, it is easy to see how the cost of rent is staggeringly out of hand and is trending on getting worse before it gets better unless a reform or affordable housing becomes more readily available.

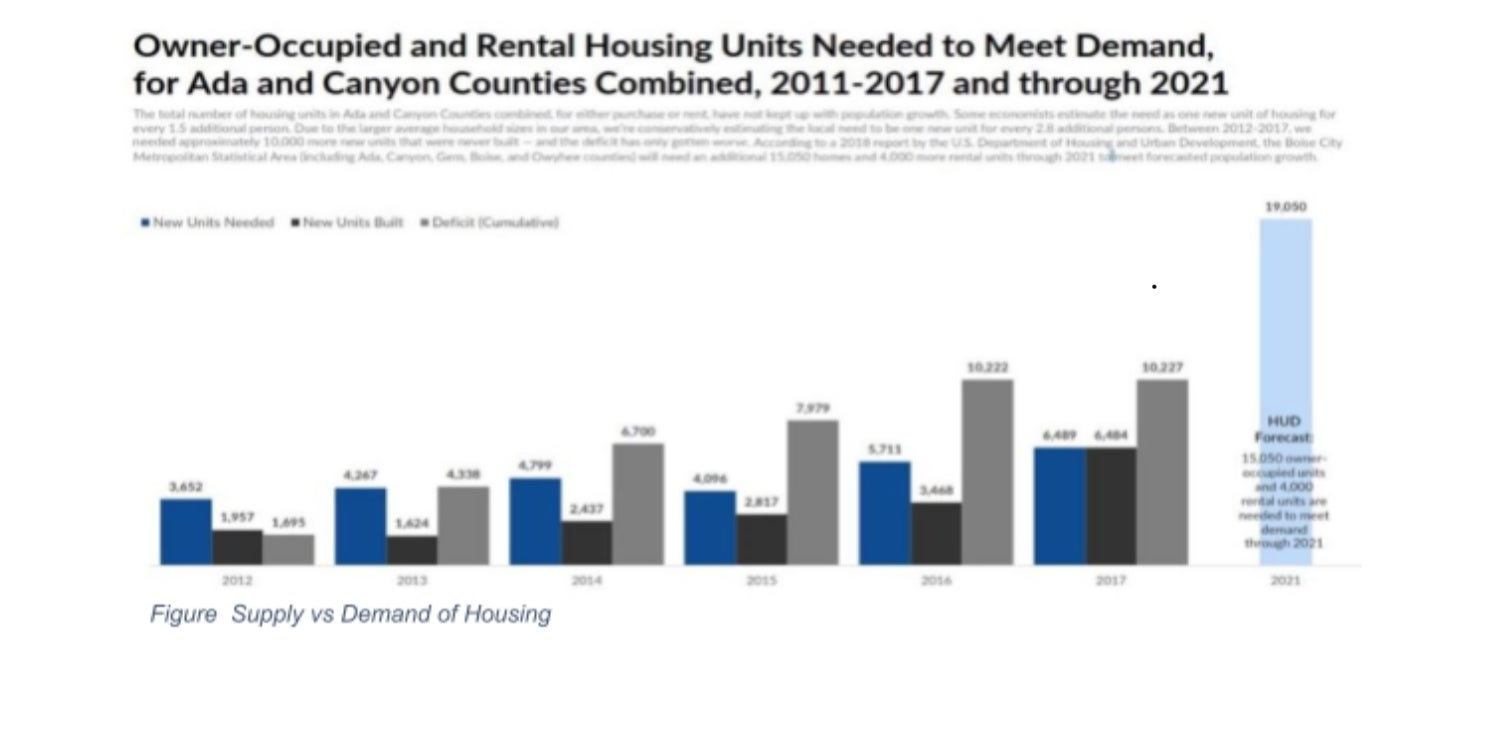

This trend of low supply and high demand can definitely be seen within the Boise area with the demand for homes being at least 10 times higher than the amount of homes actually being constructed (Siegler and Berumen). With bustling metropolises filling beyond their capacities, like Seattle and most Californian cities, people located in the northwestern coastline are looking to move inward, and one of the most popular destinations is Idaho, specifically the Treasure Valley. According to the Census Bureau from 2016, 21 percent of people moving to Idaho were from California, making it the main single source of new residents followed closely by Washington (Shaul). This data further backs up the national trend of people moving from epicenters due to overcrowding and rising costs, and since Idaho is relatively less populated than those areas, and in a prime location near many large cities just hours away, like Seattle and Salt Lake City, people are finding it a convenient place to settle.

With this influx of people moving from expensive, large cities, to a slowly growing city, homes are becoming more difficult to find for current residents. People can sell their expensive homes in large cities, like in California, and are able to take that money, and buy a cheaper home here in Idaho. What seems cheaper to a Californian, isn’t cheap to an Idahoan since there is a huge difference in the cost of living. Even if homes were able to be constructed and were cheaper, the demand is still so high that the current market cannot keep up, and would take drastic measures to fix, see Figure 2 (Terhune). This increase of people moving to Idaho, coupled with slowed construction, lack of labor, increased costs of building materials, and current residents staying in their present homes, makes for an unstable housing situation in general, which becomes especially true when considering the underinflation of wages.

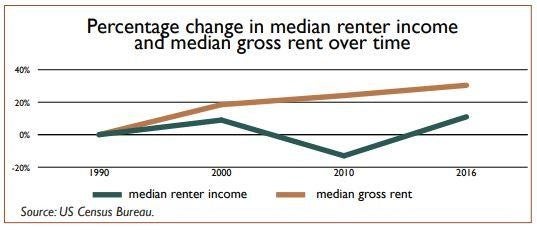

Within the Boise area, the gap between the cost of housing and the inflation of wages is only getting wider, see Figure 3 (“Housing Affordability in Idaho”). Research from the National Low-Income Housing Coalition shows that the necessary wage needed to afford a two-bedroom apartment within the Boise area is $15.44 per hour, while minimum wage is $7.25 per hour and the average renters wage is $12.19 per hour (Out of Reach: Idaho). What this data represents is how unaffordable housing is for those with an average income. Minimum wage was originally supposed to be the most basic, essential income needed to survive, however, even that isn’t allowing most people to get the necessities, like shelter and food. Data reported in 2017 from the Bureau of Labor Statistics reported Boise wages rose 1.9 percent, while the population rose 2.6 percent and the cost of housing rose 3.3 percent (Crabb). These statistics further show the gap between housing and wages, and that even with minor increases in wages, it is still not enough to keep up with the rate of expansion of housing costs.

In recent events, the new mayor, Lauren McLean, has been elected to represent Boise and it is her goal to help provide a solution and relief for this crisis. To help accomplish this goal, she has created six task forces, one of which is called the ‘Affordable Housing Task Force” (Harding). With this task force, McLean is hoping to find innovative and creative solutions to this crisis. Another solution she is proposing is the use of the land trust that was created in 2018 which hasn’t been utilized yet. A land trust has the potential to “theoretically decrease the cost for either the homeowner to buy or the developer to build apartments, making mortgages and rents lower than they would be otherwise” (Carmel). With this land trust, the local government will limit the necessary income to qualify for this housing and allow for the lease rates to be flexible depending on availability. Though these ideas proposed will help with affordable lower income housing, mainly apartments, it doesn’t completely help the issue of lack of overall housing, and affordable houses for current residents who can’t afford a house and want to escape the apartment lifestyle.

The Affordable Housing Crisis is causing many issues for people who are wanting to enter homeownership, not only through making prices impossibly high, but also making rent unbearable as well. Due to this high increase in rent, the low supply of homes, and low inflation of wages, people are finding it difficult to survive, let alone move forward in life by becoming a homeowner. This crisis affects many; not only is it majorly affecting the United States on a national level, but when narrowed down to the northwest, or even to the Boise, Idaho area, it becomes even more clear on the drastic issues arising from the lack of affordable housing, and its causes. With these issues facing todays society, the original concept of the American Dream will only stay a dream for many.

Works Cited

Carmel, Margaret. “Feasibility Study Gives Positive Outlook for a Housing Land Trust in Boise.” Idaho Press, 21 Dec. 2019, www.idahopress.com/news/local/feasibility-study-gives-positive-outlook-for-a-housing-land-trust/article_1e2324cd-1e17-57f0-be87-d26f533a2187.html.

Christensen-Garcia, Laura. “How Low-Income Renters Squeezed Out By The Affordable Housing Crisis Can Fight Back.” The Financial Clinic, 12 Sept. 2018, thefinancialclinic.org/how-low-income-renters-squeezed-out-by-the-affordable-housing-crisis-can-fight-back/

Cororaton, Scholastica, “Median Prices Rose to Highest Level, But Inflation-Adjusted Prices Still Below Bubble Peak.” Economists Outlook, 21 June 2018, economistsoutlook.blogs.realtor.org/2018/06/21/median-prices-rose-to-highest-level-but-inflation-adjusted-prices-still-below-bubble-peak/

Crabb, Peter. “Job Market Is Good, but Wages Aren’t Rising as Much as Cost of Living.” Idahostatesman, Idaho Statesman, 20 June 2018, www.idahostatesman.com/news/business/biz-columns-blogs/article213561659.html

Emmons, Garry. “No Place Like Home: America’s Housing Crisis and Its Impact on Business.” HBS Working Knowledge, Harvard, 20 Mar. 2000, https://hbswk.hbs.edu/item/no-place-like-home-americas-housing-crisis-and-its-impact-on-business

Graham, Jed. “Affordable Housing Crisis: What You Must Know About The Housing Bubble.” Investor’s Business Daily, Investor’s Business Daily, 28 Jan. 2019, www.investors.com/news/economy/affordable-housing-crisis-housing-bubble/

Harding, Hayley. “High Property Taxes. Costly Homes. Panhandling. What Boise’s New Mayor Says She’ll Do.” Idahostatesman, Idaho Statesman, 10 Jan. 2020, www.idahostatesman.com/news/local/community/boise/article239139423.html.

“Housing Affordability in Idaho.” A Chartbook by the Idaho Asset Building Network. November 2018. https://www.idahoassetnetwork.org/wp-content/uploads/2018/11/IABN-Housing-Chartbook-FINAL.pdf

Mazzara, Alicia. “Census: Renters’ Incomes Still Lagging Behind Housing Costs.” Center on Budget and Policy Priorities, 13 Sept. 2018, www.cbpp.org/blog/census-renters-incomes-still-lagging-behind-housing-costs.

“Out of Reach: Idaho.” National Low Income Housing Coalition, JPMorgan and Chase Co., 12 Mar. 2019, reports.nlihc.org/oor/idaho.

Siegler, Kirk, and Berumen, Brian. “America’s New Housing Crisis: Shut Out Of The Market.” Oregon Public Broadcasting, NPR, 6 Aug. 2018, www.opb.org/news/article/npr-the-new-housing-crisis-shut-out-of-the-market/.

Shaul, Craig. “Idaho Population Changes: Where Are People Coming From and Going To?” Idaho@Work, 22 Mar. 2018, idahoatwork.com/2018/03/22/idaho-population-changes-where-are-people-coming-from-and-going-to/.

Sowell, John. “You Already Know Boise Housing Rents Are High. Here’s How Much They’ve Increased.” Idahostatesman, Idaho Statesman, 5 Feb. 2019, www.idahostatesman.com/news/business/article225553125.html.

Terhune, Katie. “Treasure Valley Housing Crisis: 19,050 More Homes Needed by 2021.” Ktvb.com, 24 July 2019, www.ktvb.com/article/news/valley-housing-crisis-19050-more-homes-needed-by-2021/277-b04d1dcf-fd26-4f16-bd22-b06b8ce79de6.

Terwilliger, J Ronald. “Solving the Affordable Housing Crisis: The Key to Unleashing America’s Potential.” American Bar Association, 16 Mar. 2018, www.americanbar.org/groups/gpsolo/publications/gpsolo_ereport/2018/march-2018/solving-affordable-housing-crisis-key-unleashing-americas-potential/

“Where Did All the Construction Workers Go? Research Matters.” JLC Online, U.S. Census Bureau, 6 Nov. 2015, www.jlconline.com/business/employees/constructions-exodus-of-labor_c.