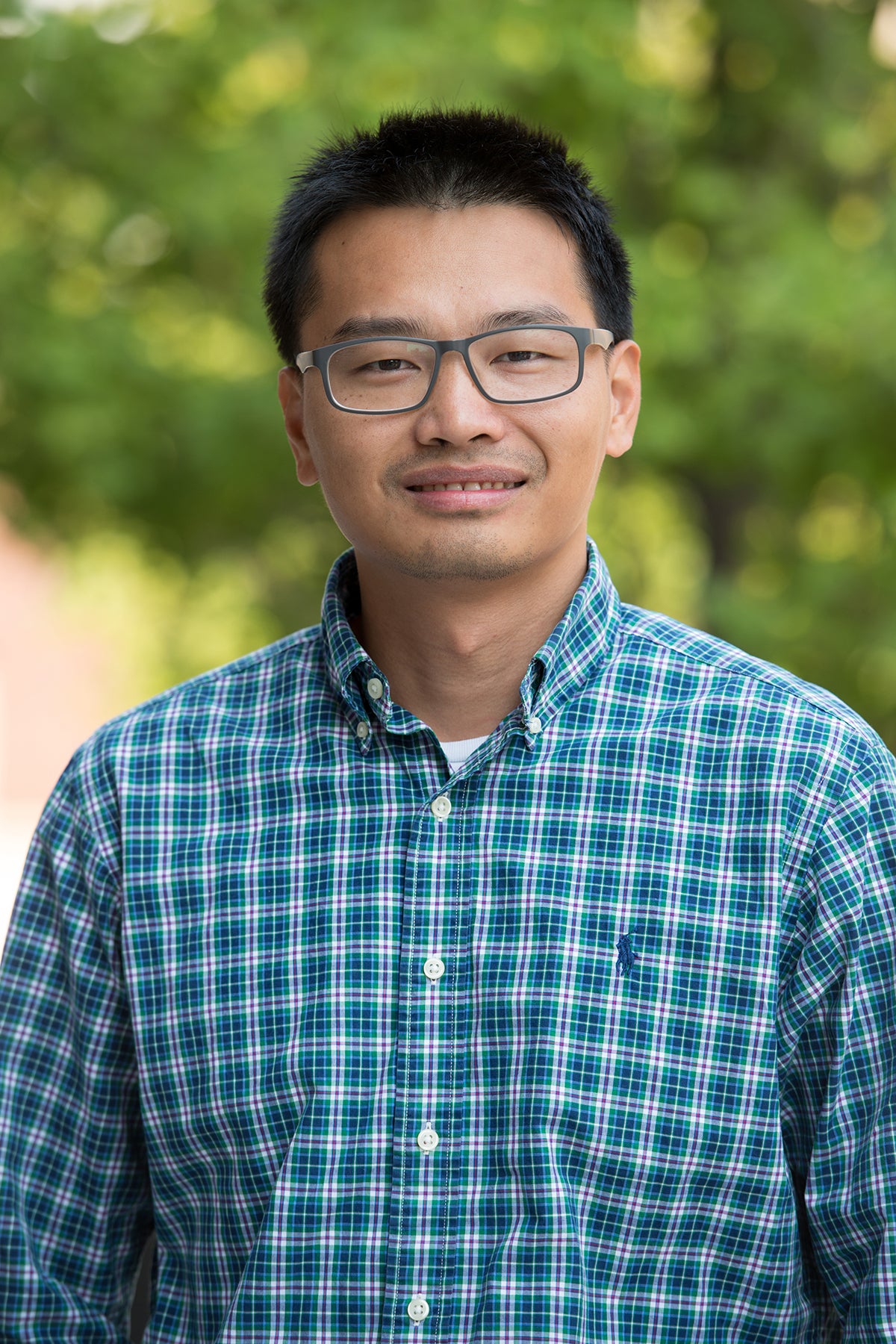

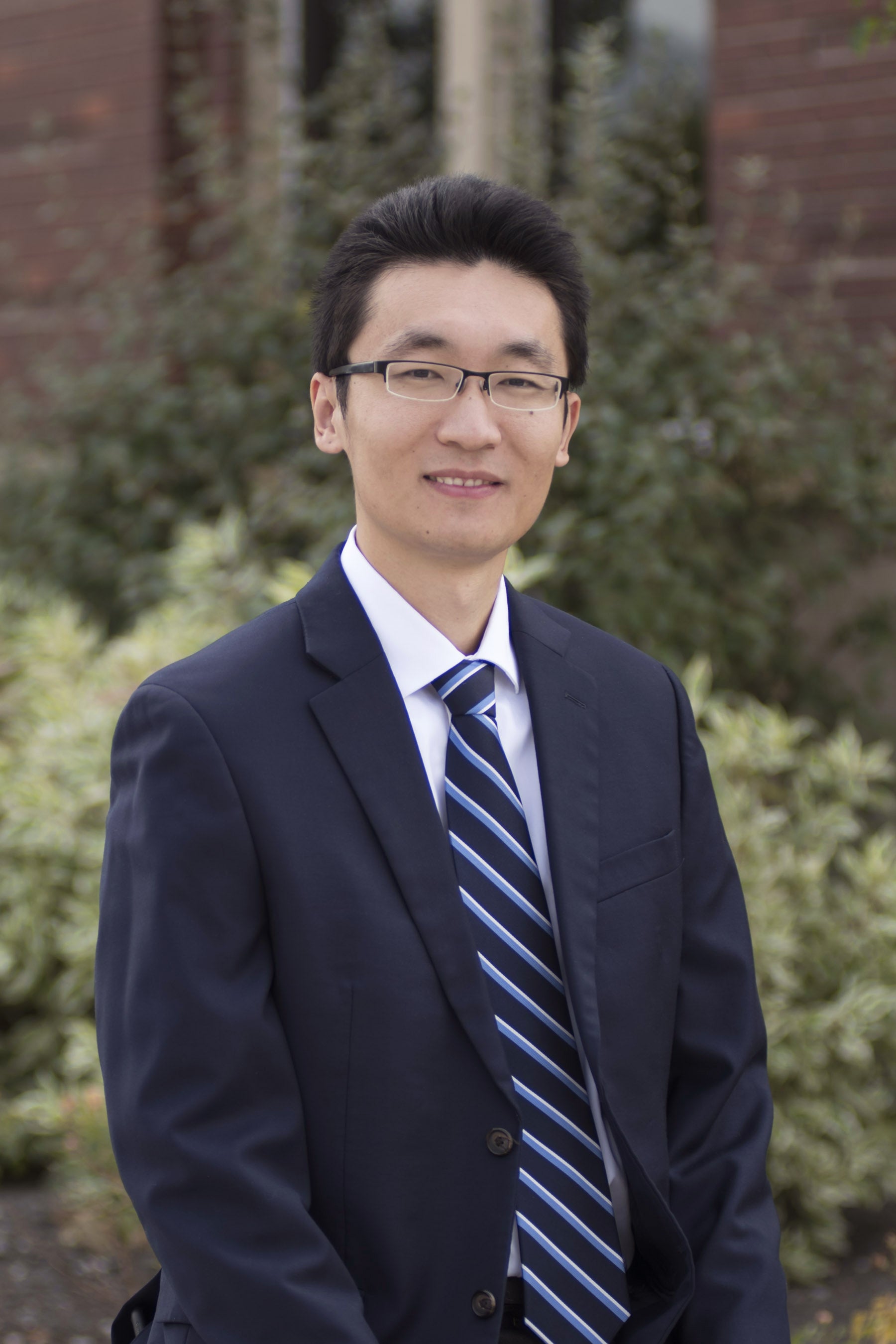

Qiping (Jimmy) Huang and Yongjia (Eddy) Li, both assistant professors in the Department of Finance, presented their paper “Hedge Fund Beta Returns as Predictors of Future Performance” at the virtual Financial Management Association Conference.

Their paper decomposes hedge fund returns into alpha and beta return components. It determines that portfolios sorted by beta return display a strong monotonic mean reversal pattern. Funds in the lowest quartile of beta return report superior performance in out-of-sample tests.

Beta return is a strong predictor of future fund performance and is not driven by systematic risk, idiosyncratic risk, total risk, alpha or R-squared. Beta returns are predictive regardless of model specification, and results are robust to fund-specific controls.

Other co-authors of the paper are Jun Duanmu at Seattle University and William McCumber at Louisiana Tech University.