Boise State’s IRS-sponsored Volunteer Income Tax Assistance (VITA) program is looking for additional volunteers in order to continue serving those in need. The program helps low-income taxpayers (anyone making less than $57,000 per year) including refugees, veterans, seniors, people with disabilities and students prepare and electronically file their tax returns for free. It’s led by a team of volunteers comprised of faculty, students and community members.

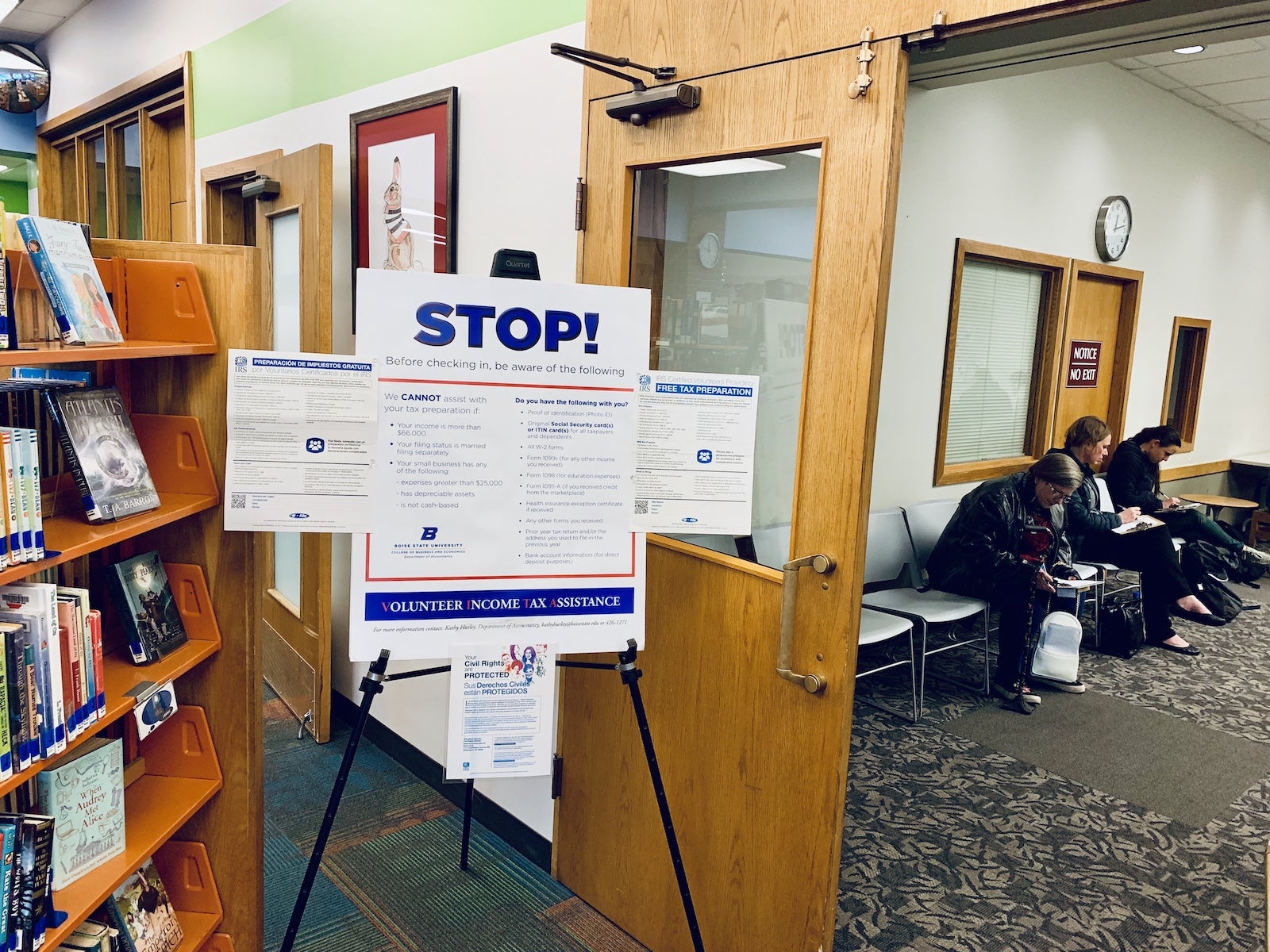

Due to the pandemic, VITA is one of the few programs still operating in the Treasure Valley, and is currently inundated with clients. Returns are prepared virtually and in-person with strict COVID safety protocols. Clients are required to make an appointment in advance via Boise State’s GivePulse site.

All new volunteers are provided training prior to taking the required IRS certification exams. The VITA program uses tax software that guides the preparer through the process with an interview style format. Additionally, new volunteers are teamed with an experienced tax preparer and will have access to resources along with an experienced volunteer to answer tax questions. All tax returns are reviewed with the taxpayer by an experienced, certified tax preparer prior to transmission to the IRS.

Two to three hours per week are required for new volunteers for either virtual or in-person returns, which mostly occur in the Micron Business and Economics Building (MBEB) on Wednesday afternoons. Other in-person and virtual returns take place on various Saturdays at MBEB, at the International Rescue Committee offices, and at Garfield Elementary School. Virtual appointments also can be scheduled.

Contact vitataxhelp@boisestate.edu if you are interested in signing up to become a VITA volunteer.